|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

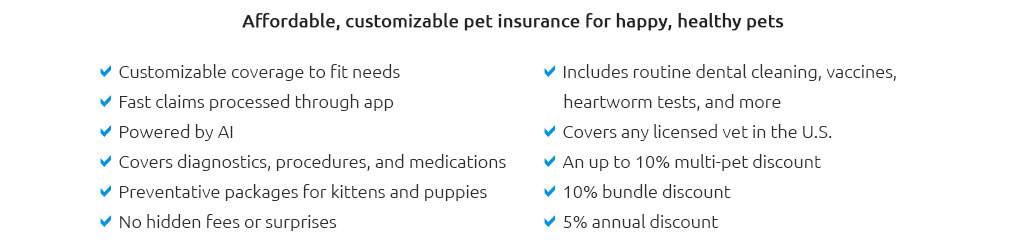

Shop for Pet Insurance: Navigating the Maze of OptionsIn today's world, where pets are cherished as family members, ensuring their health and well-being has become a priority for many pet owners. Enter the realm of pet insurance, a solution that promises to alleviate the financial burden of unexpected veterinary expenses. However, diving into the myriad of options available can be overwhelming, leading to common mistakes that could cost more in the long run. Firstly, it's crucial to assess your pet's specific needs. Different breeds come with their own set of genetic predispositions and potential health issues. For instance, larger dogs might face joint problems, while certain cat breeds are prone to kidney diseases. Understanding these nuances helps in selecting a plan that offers the right coverage. Many pet owners make the mistake of opting for a generic policy, overlooking these breed-specific considerations. Another pitfall is underestimating the fine print. Insurance contracts can be laden with jargon and clauses that may not be immediately apparent. It's imperative to scrutinize the terms, especially regarding exclusions. Some policies might not cover pre-existing conditions or have waiting periods that delay coverage. A careful examination of these details ensures that you're not caught off guard when you need to make a claim. Cost is often a significant factor in decision-making, yet it's essential to balance affordability with comprehensive coverage. Opting for the cheapest plan might save money upfront but could lead to hefty out-of-pocket expenses later. Conversely, the most expensive plan isn’t necessarily the best. Evaluate what is truly offered in terms of coverage limits, deductibles, and co-pays. A wise approach is to compare several plans and choose one that offers the best value for your pet's anticipated health needs.

Avoiding these common mistakes can lead to a more informed and satisfying pet insurance shopping experience. By understanding your pet's needs, thoroughly vetting the policy details, balancing cost with coverage, and considering the provider's reputation, you can ensure that you select a plan that offers peace of mind and financial protection against unexpected veterinary bills. In doing so, you safeguard not only your pet's health but also your financial stability, allowing you to focus on what truly matters: cherishing every moment with your furry companion. https://www.moneygeek.com/insurance/pet/

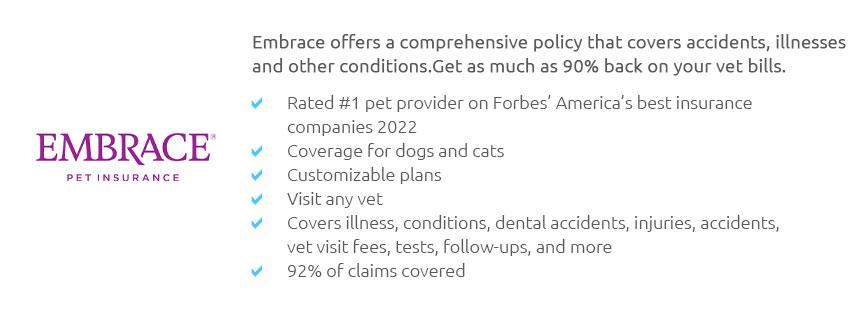

Compare Pet Insurance Quotes by Company and Coverage - 1. 24 Pet Watch. $39.03. $51.95 - 2. ASPCA. $26.54. $49.27 - 3. Embrace. $30.15. $42.75. https://www.uhone.com/health-insurance/additional/pet-insurance

Pet health insurance from Figo can help you cover the cost of your pet's basic health care as well as expenses from illnesses, accidents and injuries. https://www.nytimes.com/wirecutter/reviews/best-pet-insurance/

To find the right insurance plan, you need to know your pet's medical history and your budget. Then, prior to getting quotes, make a list of ...

|